Understanding the Significance of Bid Bonds in Building Projects

Understanding the Significance of Bid Bonds in Building Projects

Blog Article

Crucial Actions to Obtain and Utilize Bid Bonds Successfully

Browsing the complexities of bid bonds can dramatically affect your success in securing agreements. To approach this effectively, it's critical to understand the fundamental actions involved, from collecting needed documents to picking the appropriate surety copyright. The trip starts with arranging your monetary declarations and a thorough portfolio of previous projects, which can show your integrity to prospective guaranties. However, the genuine obstacle depends on the precise selection of a credible service provider and the tactical usage of the bid bond to enhance your affordable edge. What complies with is a more detailed look at these important stages.

Comprehending Bid Bonds

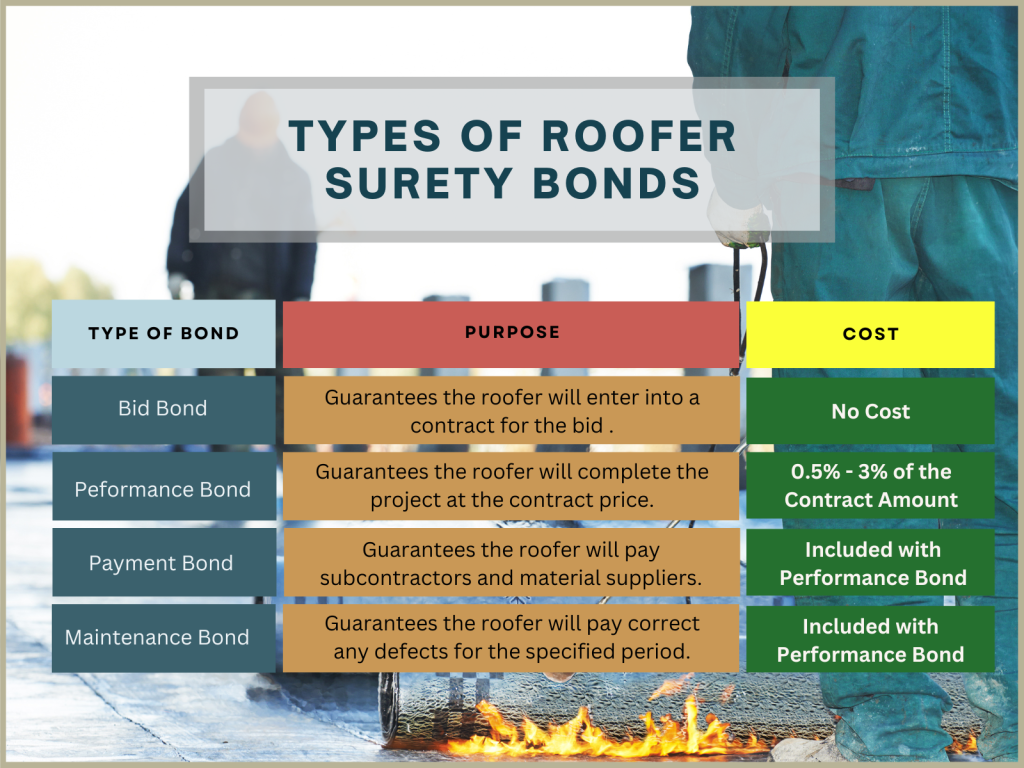

Quote bonds are an essential part in the building and construction and contracting industry, offering as a monetary assurance that a prospective buyer means to become part of the agreement at the proposal cost if awarded. Bid Bonds. These bonds mitigate the risk for task owners, making certain that the chosen professional will certainly not just honor the bid however additionally safe and secure performance and repayment bonds as required

Fundamentally, a quote bond functions as a secure, safeguarding the job proprietor versus the monetary implications of a contractor taking out a bid or falling short to begin the project after selection. Typically provided by a guaranty business, the bond warranties compensation to the proprietor, often 5-20% of the bid amount, ought to the specialist default.

In this context, quote bonds foster an extra credible and affordable bidding process atmosphere. They oblige professionals to existing sensible and severe quotes, knowing that a punitive damages towers above any kind of breach of dedication. Additionally, these bonds make sure that just solvent and qualified professionals get involved, as the extensive qualification procedure by guaranty companies displays out much less trusted prospective buyers. Bid bonds play an indispensable function in maintaining the stability and smooth procedure of the building bidding procedure.

Planning For the Application

When planning for the application of a quote bond, thorough company and extensive documentation are vital. An extensive evaluation of the job specifications and bid demands is important to ensure compliance with all terms. Beginning by assembling all needed monetary statements, including equilibrium sheets, revenue statements, and capital declarations, to show your company's financial wellness. These records need to be current and prepared by a qualified accounting professional to boost reputation.

Following, put together a listing of past tasks, particularly those similar in extent and dimension, highlighting successful conclusions and any accolades or accreditations obtained. This strategy supplies an alternative view of your company's approach to task execution.

Guarantee that your organization licenses and registrations are up-to-date and easily offered. Having these documents arranged not only expedites the application process but likewise predicts a professional picture, instilling self-confidence in possible guaranty suppliers and job official site owners - Bid Bonds. By methodically preparing these aspects, you place your firm favorably for successful bid bond applications

Locating a Guaranty Provider

A guaranty firm familiar with your field will certainly much better understand the special threats and demands associated with your jobs. It is likewise advisable to examine their economic scores from agencies like A.M. Best or Criterion & Poor's, guaranteeing they have the monetary toughness to back their bonds.

Engage with several service providers to contrast rates, terms, and services. A competitive evaluation will certainly aid you safeguard the very best terms for your bid bond. Inevitably, a comprehensive vetting procedure will certainly ensure a reliable partnership, fostering self-confidence in your quotes and future projects.

Submitting the Application

Sending the application for a quote bond is a critical step that needs meticulous interest to detail. This process begins by gathering all appropriate paperwork, consisting of financial declarations, project specifications, and a thorough business history. Making sure the accuracy and efficiency of these papers is extremely important, as any discrepancies can lead to denials or hold-ups.

When loading Get More Info out the application, it is recommended to ascertain all entries for precision. This consists of validating figures, guaranteeing correct signatures, and validating that all required attachments are consisted of. Any omissions or mistakes can threaten your application, causing unneeded complications.

Leveraging Your Bid Bond

Leveraging your quote bond properly can significantly boost your competitive edge in protecting agreements. A bid bond not only shows your financial security yet also comforts the task proprietor of your commitment to satisfying the agreement terms. By showcasing your quote bond, you can underscore your firm's reliability and reputation, making your bid stick out amongst countless competitors.

To leverage your quote bond to its maximum capacity, useful source ensure it is provided as component of a detailed proposal package. Highlight the toughness of your guaranty supplier, as this shows your business's monetary wellness and operational capacity. In addition, stressing your performance history of efficiently finished projects can better infuse self-confidence in the task proprietor.

Moreover, maintaining close interaction with your guaranty supplier can help with far better terms in future bonds, therefore strengthening your competitive positioning. A positive method to handling and renewing your quote bonds can additionally avoid lapses and make sure continual protection, which is important for recurring task procurement efforts.

Final Thought

Effectively obtaining and utilizing quote bonds necessitates comprehensive preparation and strategic implementation. By comprehensively organizing key documentation, picking a credible guaranty copyright, and submitting a total application, firms can protect the required quote bonds to improve their competition.

Identifying a reliable surety company is a critical step in protecting a proposal bond. A proposal bond not just demonstrates your monetary security yet additionally guarantees the job owner of your commitment to meeting the contract terms. Bid Bonds. By showcasing your quote bond, you can highlight your firm's integrity and trustworthiness, making your proposal stand out amongst various competitors

To take advantage of your bid bond to its max capacity, ensure it is presented as component of an extensive bid plan. By adequately organizing key documents, picking a respectable guaranty provider, and submitting a total application, firms can protect the essential bid bonds to boost their competition.

Report this page